Are you making these tax time mistakes?

It’s that time again.

No, not coffee time… tax time! June 30 is fast approaching and with it a collective sigh from business owners and employees everywhere. Because everyone’s thinking the same thing: am I getting the most out of tax time? Am I paying too much tax? And how would I know anyway?

This is where tax planning comes into play. Tax planning simply means planning ahead to ensure that your tax is kept to a minimum. Just like no one goes out intending to pay extra for a meal at a restaurant, no one plans to donate extra to the ATO ‘just because’. Tax planning within the letter and spirit of the law helps avoid this scenario. Unlike a restaurant meal however, the complexities of tax planning often elude the capacity of the everyday diner… and we’re stuck not knowing which end is up. This often leads people to make mistakes – and what’s worse, avoidable mistakes that could be costing you money!

Which brings us here. This quick guide is about helping you to avoid the seven deadly sins of tax planning. And not only that, but we’re revealing how you can find solutions and attain the ‘seven virtues’ of tax holiness instead (plus take a load off your mind). It’s all about being proactive:

Deadly Sin #1: Acting late

The first big mistake is leaving it all too late. A failure to plan is a plan to fail. If we act too late it’s a bit like rolling the dice – we have no ability to control the outcome and we’re sure to miss opportunities that may have helped to improve cash flow, increase our super balance, or help build capital into the business.

Lots of people act too late because they buy into a sense of ‘fatalism’ thinking, “There’s nothing I can do about tax anyway, it is what it is.” But we’ve proved time and time again that there are so many factors and variables within your control that can drastically change the outcome of your tax bottom line. Don’t stumble over the line – finish fiscally strong – and here’s how…

Solution: You still have time! It’s still May, which means now is the perfect time to start your tax planning by booking an appointment today. Not knowing what to expect in a tax planning session also tends to cause people to fall into the deadly sin of acting late, so check out what to expect in your tax planning session, and read on for how you can get prepared for it in the space of your lunch break.

Deadly Sin #2: Living minute to minute

Much like the first, the second deadly sin of tax planning holds us in the eternal purgatory of never being ready for EOFY… which means we’re also never ready for the year ahead. Lots of people underestimate the importance – and the time-saving power – of weekly or monthly maintenance when it comes to business bookkeeping.

Living minute to minute is a lot like acting late… you will miss golden opportunities to save and invest for the future of your business and your family. It also means you rob yourself of the ability to grow and cast vision and generate new ideas because you’re constantly under the pressure of structures that are letting you down.

Solution: Overcoming this deadly sin is all about habits. Although habits can form in as little as 18 days, studies have shown that if you give yourself around nine weeks – 66 days to be precise – you’ll be unstoppable. Using those random ‘minute to minute’ moments differently each day or each week to record and code receipts and attend to basic bookkeeping can turn you from ‘last minute’ to ‘long-term planner’, and open up a new world of opportunities.

Deadly Sin #3: Working in isolation

The next sin is one that captures all of us from time to time. We think we can go it all alone – but then we find out down the track we’ve missed something vital, or there was information out there that could’ve changed the way we set up our system to save us.

Isolation is a killer. Much like the trap we fall into with goal-setting, isolation when it comes to tax planning will leave us without a leg to stand on when we encounter problems, complications or the bigger strategic questions of tax time and beyond.

Solution: That’s why we’re here! Going it alone is a surefire way towards the path of avoidable (and costly) mistakes, so it’s important to book today for a tax planning meeting, or as we like to call it, a ‘proactive, goal-orientated, cash flow management session’. And just in case you were expecting a yawn-worthy event, don’t! Here’s what to expect when you decide to work with us on your tax planning, and how you can easily prepare for it.

Deadly Sin #4: The old ‘receipts in the shoebox’ trick

Maybe you’re one of those people… No judgement! We get it! And we’ve all been there at some time or another (so you’re among friends!). But it’s time to leave the old ways for bigger and better things…

Whether it’s a literal shoebox, a cabinet draw, or across four different handbags… receipts tracking (or lack thereof!) and ‘old school’ methods in general, are disasters waiting to happen for many individuals and businesses. Without up to date structure to support your daily operations, there is a strong chance of misplaced records, lost time tracking information, and an inability to view data trends over time. All of these are valuable tools that a lack of planning is robbing from your business.

Solution: Stop with the shoebox! Start small and test a simple strategy (a free tool, such as a simple spreadsheet, is a good place to start), and build your habits slowly. Then after a while you’ll start to work out what you really need in a system or software product, and be able to make informed decisions on how to move forward. Starting simple not only saves you some outlay on a whiz-bang software program, but it also means you give a chance for good habits to form – and then you’ll know whichever system you end up choosing will propel you into the future, because you’ll use it!

Deadly Sin #5: Sacrificing cashflow for “tax reduction”

Have you heard of the saying, “be sure your sins will find you out”? Well here’s one that’ll definitely bite when it comes back around.

Without prudent and strategic advice, it is possible to go too far towards “tax reduction”. In efforts to minimise the bottom line, people can pour lump sums into investments or other “tax reducing methods”… only to find that cash flow is adversely affected, with negative implications for day to day operations and expenses.

Solution: Weigh up the pros and cons of your investments. Talk over your investment plans and goals with an advisor who can help you see the big picture, not just the next 60-70 days ahead. The end goal is not simply to ‘pay less’, the bigger picture will help you make the most informed decision so your can meet your obligations in a way that sets you up for success in the long term – without having to sacrifice your cash flow in the process.

Deadly Sin #6: Exceeding super limits

This is a ‘super’ sin! And one mistake you might not even know you’ve made until it’s too late. Although there are generous tax concessions and incentives for contributing to super both before and after tax, there are also caps on these provisions. If you exceed these limits, and fail to rectify it in a timely manner, you will end up paying more tax anyway, which can hurt your cash flow and your tax bottom line.

It’s also helpful to note that the cap totals for super contributions apply to the combined amount of your super balance across all your super funds, not just the one you’re contributing to, so when it comes to super, knowledge, organisation and careful planning are key.

Solution: Be aware of the caps for super contributions, including both how much you can contribute before tax and after tax. And consolidate your super funds (or be aware of how many accounts you have and their respective balances) to ensure you’re not leaving out chunks when you calculate the total balance of your super.

Deadly Sin #7: Living reactively, not proactively.

If you’re always reacting to tax time, you’re doing it wrong. This mistake means your focus is always on the past, and all the things you can’t change. Being proactive places you, your business, and your family firmly on the front foot and into the future – the domain of possibility, new ideas, and growth.

Most people fail to realise that tax time is more than meeting your obligations. It’s about how I can take stock and take advantage of my systems and structure to set up my business in a position of strength for the year ahead. Living reactively is a mistake because it restricts a growth mindset, and ultimately restricts your growth reality.

Solution: Our mission is to help our clients achieve over 1000 business and personal goals by the year 2020, and we’re achieving that goals everyday by guiding our clients through proactive strategies that are tailored to your personal situation. Being proactive doesn’t have to take forever – rather it’s about a few minutes today that will save a lot of time tomorrow. And we believe in our mission so much that we’ve made available to you some free tools to help you turn from reactive to proactive in a matter of minutes.

A Final Tax Saving Tip

Just because tax has to be done, doesn’t mean it has to be hard. And the way to make life easier this tax time and beyond it to start your tax planning right now. And you can get it done in less than one hour. Yes, book yourself a long lunch, and before you know it you’ll be all ready to plan ahead not only for this year’s tax, but with a system sorted for future years as well.

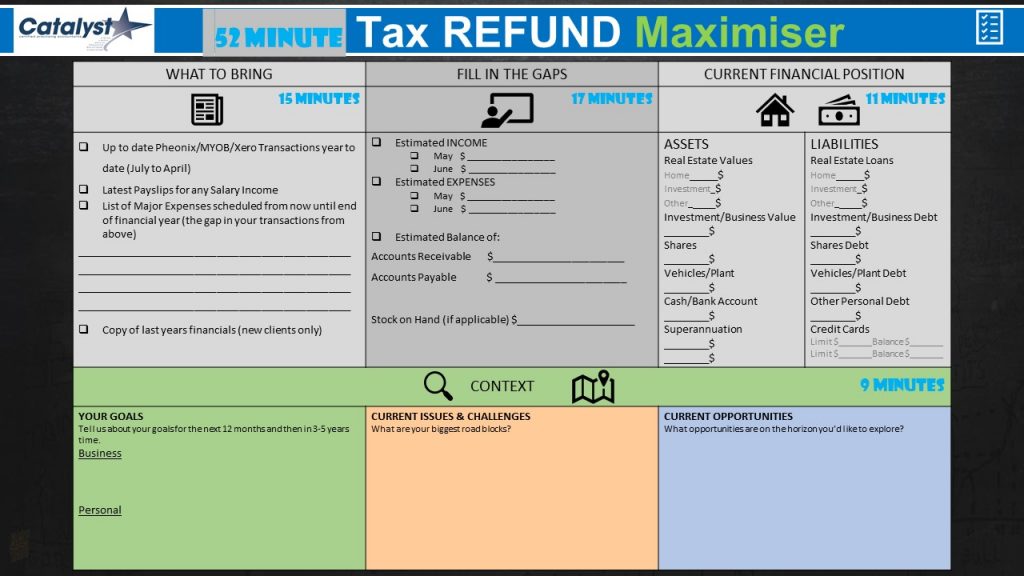

That’s because we’ve created the ultimate tax planning checklist. Our 52 Minute Tax Refund Maximiser is a simple one-page tool that will have you prepped and ready for tax time, all in under an hour. Being proactive doesn’t have to chew hours out of your free time – in fact, it can give hours back to you in the form of less tax time headaches, and more time enjoying the rewards of careful planning and all your hard work.

We’re here to help you reach your goals. Yes, the hassles and complexities of tax time are upon us all, but we’re here to help you think bigger and see a life beyond your receipts shoebox. If you’re ready to leave behind the seven deadly sins of tax planning and find a better, less stressful, way forward, give us a call and book a time to catchup today.