The WHY, WHO, WHAT & WHEN…sorted

In the economic storm of COVID-19, it seems Australia will keep her head above the swirling waves thanks to the Federal Government’s diverse package of cash injections and incentives targeting businesses right across the country.

The problem is, how do you know exactly what’s what? How do you make sure you’re not missing out on opportunities that could benefit you? Whilst at the same time making sure you’re fulfilling your usual tax obligations?

So we’re making it easy.

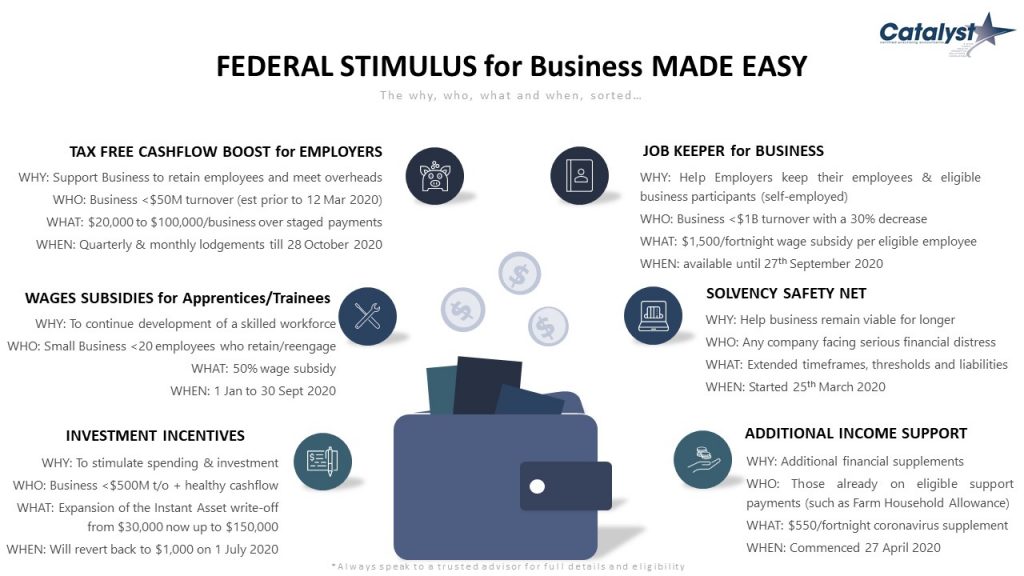

Within the great variety of measures, tonnes of information, article upon article and link upon link, we’re answering the questions business owners have on their mind and cutting straight to the chase with our simple one-page guide on the Federal stimulus initiatives for business.

Read the FEDERAL STIMULUS for Business MADE EASY guide below and then or scroll down for our Quick Action Checklist.

You can download it here.

As always, we strongly recommend getting specific advice for your situation from a trusted advisor, to ensure you are looking at the right initiatives for your situation. We are here to help if anyone is unsure or needs a hand to put their best foot forward in these turbulent times.

This event has taken its toll in many ways, but always remember: your goals are our goals – don’t walk alone! If you think you fall into one or more of these categories, and you’d like to talk through what’s next for your business, give us a call and book a time to catchup today.

We’re here to help.

We have also put together a simple checklist that may help you on your way and point you in the right direction.

QUICK ACTION GUIDE FOR BUSINESS OWNERS:

- Forward your BAS information to us ASAP so we can determine your eligibility for any cashflow boost credits.

- Take care of your employees:

- Call an Australian Apprenticeship Support Network (AASN) provider today to start your claim for wage subsidies if you employ apprentices or trainees.

- Ask us to get you enrolled for Jobkeeper payment/s and help you manage the process and compliance.

- If you’re considering new asset purchases, talk to your accountant as soon as possible (essential before EOFY).

- Debt piling up? Get in touch with the ATO on 13 28 61 or contact us to arrange a tailormade solution immediately.

- Need to apply for Farm Household Allowance? Faster claims processing and the Coronavirus supplement has now commenced, so ask us to apply on your behalf today.